Investment in Real Estate

Are you one of the many investors that is looking to buy a property in the UAE? Looking to take advantage of the rising rental yields and real estate prices in Dubai? Thinking of buying a property in Dubai (UAE) but confused about the individual tax implications?

Did you know?

It is true that in UAE there are no individual taxes on one’s personal income such as derived from sale of property and/or rent, however this doesn’t necessarily mean there are no tax obligations related thereto in country of tax domicile of the recipient of such income, despite popular opinion. Keep in mind, real estate agents and developers aren’t licensed tax advisors, their job is to sell the property.

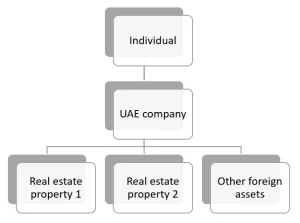

The key advantages of holding your real estate property under the company are:

- Privacy and discretion, as list of partners or shareholders of the companies isn’t accessible to public,

- Significant tax advantages based on number of bilateral double tax treaties entered by UAE, in comparison with individual ownership,

- Streamlined estate and asset planning purpose.

Based on your profile, requirements, and expectations you can choose from following options:

- Mainland holding company – ideal for holding of all kinds of assets, both UAE based and foreign, including freehold real estate located within UAE (all seven emirates).

- Free zone holding company – selected Dubai Free zones offer opportunity to own real estate in Dubai, subjected to no objection certificate issued by the freezone authority, it is fast and cost-effective solution if you need to hold and manage freehold property in Dubai.

- Offshore company – while offering attractive low incorporation costs, it has limited access to UAE banking facilities and most importantly only limited substance in UAE.